Payroll integrity: The key to safeguarding your greatest asset — your people

May 14 2025

Inherent in every employee's relationship with their employer is the expectation of being paid correctly. Sadly, employees themselves are often the ones who identify errors in payroll.

Many organisations are investing heavily in employee well-being benefits and career development initiatives to strengthen their employee value propositions while overlooking their staff's most fundamental priority – being paid correctly.

A survey conducted by LinkedIn found that more than 75% of job seekers research a company's reputation and employer brand before applying for a role 1. In today's highly competitive and transparent job market, payroll integrity isn't just about compliance, it is a strategic advantage that directly impacts employee engagement, loyalty, and your organisation's reputation.

In the current high cost- of- living environment, even a single wage error can undermine employee loyalty, especially if the company is posting record profits. Young workers 2 , migrants 3, 4 and minimum wage earners are disproportionately impacted by wage errors and are among those least likely to complain, due to the vulnerability of their positions.

Payroll errors come at a high price, both financially and reputationally. As a business leader, few things are worse than realising you have underpaid your staff. Yet, the payroll functions of many Australian organisations are underweight 5.

The list of organisations that have been impacted by wage scandals is staggering — large retailers, banks, mining companies, law firms, hotel groups, universities, and large not-for-profits — to name a few. Although wage remediations have become a focal point for the largest employers in Australia over the last few years, many others are yet to address this complex problem.

The Fair Work Ombudsman (FWO) reports $1.5bn in back-payments to workers in Australia across the last three years alone 6, and a recent study showed that 59% of payroll managers admitted to making a payroll error in the past two years, with error rates escalating as workforce numbers increase 7.

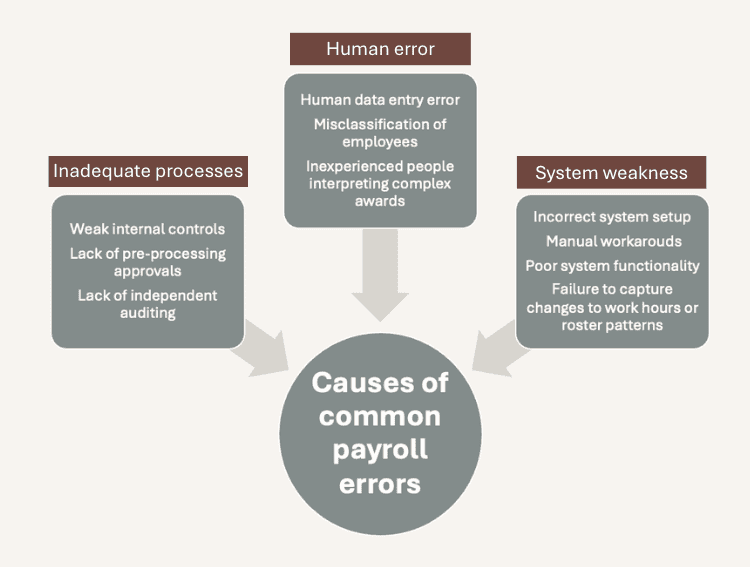

The reason for the widespread issue is twofold. Australia has one of the most complex wage systems in the world, and many organisations have failed to adequately invest in resources, training and technology to meet this challenge. Some organisations adopt a 'set and forget' mindset with payroll, a risky approach given the severe consequences of errors. However, as payroll complexity increases, so does the risk—requiring continuous attention and investment in technology and expertise.

Many payroll functions use outdated software with limited functionality for the complex calculations needed. Furthermore, 63% of respondents in the same study 7 use three or more different systems to handle payroll and HR operations, most often with no integration to rosters, timesheets or other systems of record. Even sophisticated, modern payroll applications developed in the US or Europe are not well equipped to handle the extent of complexity of pay rules in Australia.

Because of this, many payroll functions in Australia rely on supplemental manual processes 5, further exacerbating the risk of error.

This issue is not confined to specific sectors; however, the scale of the problem is likely to be worse where the payroll includes casual or shift workers, or employees with variable work conditions such as overtime, allowances, or penalty rates. These workers are paid under highly complex Enterprise Bargaining Agreements (EBAs) and Employee Awards (EAs). High-risk sectors include aged care services, agriculture, building and construction, disability support services, fast food, restaurants and cafés, large corporates and universities 6.

According to the latest data from The Department of Employment and Workplace Relations, 34% of all Australian employees are covered by EBAs 8, of which there are more than 10,800. This is the highest number since 2014. A further 23% 9 are covered by the 124 different EAs 10.

To further complicate matters, some employees can be covered by both, with the need for employees to apply the “Better Off Overall Test”. The plethora of pay rates, penalty rates and allowances, superannuation, long service leave, carers and sick leave, breaks and overtime arrangements that must be considered adds up to a very complicated set of rules, highly susceptible to miscalculation.

As part of your organisation's governance and risk management framework, payroll integrity must be prioritised to prevent legal, reputational, and operational risks. Responsibility for payroll integrity may sit with the CFO, Head of HR or the Legal function, however input is needed from all three, as well as IT, Operations and Internal Audit to get this right.

Recent workplace laws applicable from the start of 2025 have introduced criminal liability for intentional wage theft, putting a spotlight on payroll compliance.

Proactively performing a high-level review would be a good place to start to mitigate your organisation's risk. Getting it right is vital to safeguarding your organisation's most valuable asset — your people. It can also help you avoid a long and costly remediation program. Remediation programs take, on average, 1 – 4 years to complete — a very long period of disruption — with many stakeholders to manage including employees, unions, regulators, the Board and the media.

In future articles, we look at how senior executives and boards can assess their payroll compliance risk, and we look at strategic considerations for remediation programs.

References:

Linkedin Talent Solutions. ‘Employer Brand Statistics’. n.d. https://business.linkedin.com/content/dam/business/talent-solutions/global/en_us/c/pdfs/ultimate-list-of-employer-brand-stats.pdf.

‘Wage-Theft Is Rampant in Many Industries. Meet the Service Delivering Justice for Young Workers | Community Legal Centres NSW’, n.d. https://www.clcnsw.org.au/the-service-delivering-justice-young-workers.

Coates, Brendan, Trent Wiltshire, and Tyler Reysenbach. ‘Short-Changed: How to Stop the Exploitation of Migrant Workers in Australia’. Grattan Institution, May 2023. https://grattan.edu.au/wp-content/uploads/2023/05/Short-changed-How-to-stop-the-exploitation-of-migrant-workers-in-Australia.pdf.

Farbenblum, Bassina, and Laurie Berg. ‘International Students and Wage Theft in Australia’. SSRN Scholarly Paper. Rochester, NY, 30 June 2020. https://doi.org/10.2139/ssrn.3663837.

‘New Research Reveals Skill Shortages and Automation among the Biggest Pain Points for the Australian Payroll Sector’. ADP, 24 March 2025. https://au.adp.com/about-adp/press-centre/skill-shortages-and-automation-among-the-biggest-pain-points-for-the-australian-payroll-sector.aspx.

‘Australian workers back-paid $473 million’. Fair Work Ombudsman, 23 October 2024. https://www.fairwork.gov.au/newsroom/media-releases/2024-media-releases/october-2024/20241023-annual-report-2023-24-media-release .

‘The State of Australian Payroll’. Rippling, n.d. https://www.rippling.com/en-AU/resources/wage-theft-findings.

‘Employee Earnings and Hours, Australia, May 2023 | Australian Bureau of Statistics’, 21 February 2024. https://www.abs.gov.au/statistics/labour/earnings-and-working-conditions/employee-earnings-and-hours-australia/latest-release.

‘Trends in Federal Enterprise Bargaining’. Department of Employment and Workplace Relations, Australian Government, December 2024. https://www.dewr.gov.au/download/16955/trends-federal-enterprise-bargaining-december-quarter-2024/39851/trends-federal-enterprise-bargaining-december-quarter-2024/pdf.

‘List of Awards’. Fair Work Ombudsman, Australian Government, n.d. https://www.fairwork.gov.au/employment-conditions/awards/list-of-awards .

To get started with your payroll integrity review, contact KSIB or email us directly

Sharon Broekhuizen, Managing Director

sharon@ksib.com.au