AI is revolutionising finance functions, but can we trust it?

May 10 2025

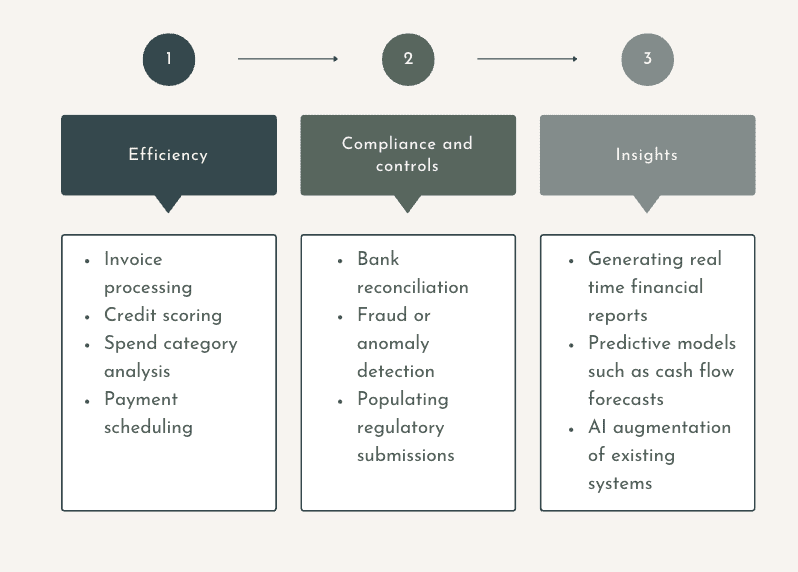

Every finance function leader has at least three critical priorities, and AI is transformative in each of these:

Efficiency - streamlining finance processes.

Compliance and control - ensuring financial health, mitigating risk and maintaining governance.

Insight - enhancing decision making, using business intelligence, reporting and performance monitoring.

The opportunity is significant – some suggest as significant as the introduction of the spreadsheet in the 1980’s.

A BCG 1 study highlighted that AI is being used in the finance function to automate compliance and control activities, drive efficiency, accuracy and scalability and make better decisions.

Common current uses for AI in the finance function

With this opportunity in mind, in the first piece in our Safely navigating AI series we argue that the biggest risk with respect to AI innovation is not taking the first leap forward. Executives must ensure that this is done in a safe way.

"We're using ChatGPT to do things like unify data from different sources and code AP invoices. That shortens our close, which is something all controllers think about" Tech veteran and OpenAI CFO Sarah Friar 2

However, AI does not produce a definitive ‘right’ answer; instead, it generates the most probable response based on available data. This raises the critical question: Can we trust the data?

Trust is especially crucial in finance, where regulatory compliance, financial accuracy, and risk management are paramount.

Only 49% of IT leaders in Australia 3 are confident in the data their company uses today.

This is especially concerning since data readiness – clean, accurate and reliable data – is essential to turn AI into a powerful business asset. AI amplifies the value of data by an order of magnitude.

A study by Avanade 4 found that 67% of Australian organisations cited poor data quality and data governance as key inhibitors of AI progress. Similarly, IBM’s Institute of Business Value in partnership with Oxford Economics, surveyed 5 400 global leaders across 17 industries, identifying concerns about data accuracy, bias, insufficient proprietary data and data privacy. 85% of the respondents are implementing or have implemented new data platforms and data governance standards.

Building trust in your data

To ensure the data used in AI within your finance function is appropriate and reliable and consistently meets the high standard of scrutiny inherent in financial reporting, we suggest you focus on:

Implementing policies for data collection, storage, sharing and use, as well as data oversight such as monitoring and issue management.

Ensuring that data is identifiable and traceable across its entire lifecycle from collection, through categorisation, integration, organisation, transformation, storage and use.

Ensuring that the entire lifecycle of data flow is auditable, with a documented data lineage capturing the end-to-end view of data transformations and flows.

Access control, anonymisation and encryption of data where appropriate.

Automated validation and integrity checks to prevent errors from persisting, supplemented by regular data cleansing and validation of the accuracy, completeness and currency of data.

Human oversight: monitoring and control by finance experts to ensure accurate, reliable, compliant, and ethical data use. AI lacks contextual judgment, making human oversight essential.

Education of users of data along the lifecycle.

The finance function's role in AI-ready data strategy

As a central function, finance is uniquely positioned to define the enterprise-wide data strategy by:

Prioritising data quality and consistency - establishing high standards for data structure, entry, aggregation, storage, and protection. CFOs can also drive transformation in the functions that produce much of the data finance consumes.

Advocating for investment in a flexible data backbone. Implement a scalable, technology-enabled data architecture that ensures a single source of truth while adapting to evolving business needs.

Allocating finance capability for data validation. Investing in data quality at the point of entry is more efficient than rectifying errors later. Finance professionals must also enhance their understanding of data limitations and resolution methods.

Leveraging technology for better data integrity. While data cleaning was traditionally a manual and time-intensive task, machine learning algorithms can now cross-reference and validate data, reducing errors and ensuring higher data quality at the ingestion stage.

AI has the potential to revolutionise the finance function, but its efficacy depends on data quality, AI governance, and security. Organisations that prioritise data readiness and responsible AI adoption will unlock AI’s full potential, enabling accurate financial insights, stronger compliance, and informed decision-making.

References:

Demyttenaere, Michael, Alexander Roos, Hardik Sheth, et al. ‘Generative AI in the Finance Function of the Future’. BCG, 22 August 2023. https://www.bcg.com/publications/2023/generative-ai-in-finance-and-accountinghttps://www.bcg.com/publications/2023/generative-ai-in-finance-and-accounting.

Yee, Lareina. ‘What an AI-Powered Finance Function of the Future Looks Like’. At the Edge, published by McKinsey & Company, 4 November 2024. https://www.mckinsey.com/capabilities/mckinsey-digital/our-insights/what-an-ai-powered-finance-function-of-the-future-looks-like.

Ambrose, Sascha. ‘94% of Australian Leaders Want More Value From Data - Here’s How to Get It’. Salesforce ANZ Blog, 20 February 2025. https://www.salesforce.com/au/blog/data-maturity-age-of-ai/.

‘Avanade Trendlines: AI Value Report 2025’. Avanade, 2024. https://ava-p-001.sitecorecontenthub.cloud/api/public/content/trendlines-research-full-report.

‘AI in Action 2024’. IBM, 2024. https://www.ibm.com/downloads/documents/us-en/107a02e95248fdc3.

To discuss how you can take charge in defining and implementing a robust data strategy for your organisation to ensure AI-driven success, contact us at KSIB or email us directly

Sharon Broekhuizen, Managing Director

sharon@ksib.com.au